There is a lot of hype around digital twin and thread. After 30+ years in virtual product development and product lifecycle management, I prefer to talk about specific requirements and solutions in this field. This article introduces use cases for the digital thread in the automotive industry and SENSEI as our solution for integrating data along this thread.

Product Development

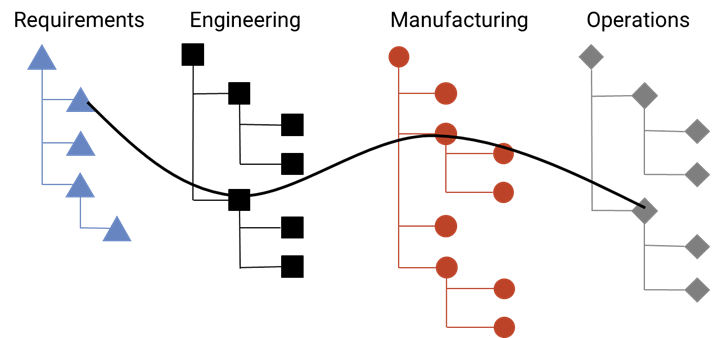

The digital thread starts in early product development phases. Even before we have well defined requirements structures, there are less structured inputs on strategy, product portfolio, positioning and mandatory usage of common parts. But if we follow the RFLP (Requirements – Functional – Logical – Physical) approach that describes the left wing of the systems engineering V model, our requirements structure is connected with functional and logical architecture structures. In the next step we arrive at physical product structures, e.g. mechanical engineering BoMs (bill of material) with items such as CAD models, electrical and electronical BoMs for wire harnesses and PCBs and software BoMs with modules, packages etc..

Many automotive companies are currently focused on building software capabilities for the software-defined vehicle. Please refer to Automotive Software Application Lifecycle Management for ACES (ACES ALM) for more information on this topic.

I like to think of the product structure as a skeleton of the digital twin. The digital thread connects items and structures with each other. The links are as much a part of the digital twin as the items (nodes), i.e. they need to be managed with the same attention regarding documentation, change management, monitoring etc.. In automotive, we are looking at thousands of requirements, functions and parts.

Engineering structures are not complete with RFLP, we also need the respective integration, validation and verification artifacts on the right wing of the V model as well as production planning and manufacturing BoMs.

Digital Thread connecting product structures

This leads

us to the following use cases for the digital thread in product development:

- Horizontal and vertical traceability of engineering structures in the systems engineering V model

- Configuration & change management in the engineering structures with versions, revisions, alternatives, options, branches and baselines

- Provide authoritative data for type approval (homologation)

- PLM – ALM integration: Integrating the ACES software development processes with the overall development of the mobility system

The challenge here is not only to manage the volume of links in the digital thread – graph databases can go a long way in this field – it is also the user experience. To scale in a globally distributed engineering organization with hundreds of external suppliers and service providers, we need a robust method for link management. Business process management has the potential to guide users through the complexity and ensure proper link management.

Product Operations

OEMs have always earned substantial money through after-sales. Data is the new oil: the car as a “smart connected product” has a lot of sensors, generating data which is constantly delivered to the cloud / backend. This availability of data is a strong driver to extend the digital thread into the after-sales phase to enable data-driven engineering and to ensure regulatory compliance.

The Chinese regulation for real-time monitoring (RTM) requires the provision of data on battery status, geo position and about 60 further data points – measured every 10 seconds. Notwithstanding the data privacy issues, this is valuable data for battery development and charging infrastructure planning. The UNECE regulations for software update and cyber security management require a mapping between the engineering information on compatibility of software and E/E hardware versions with the as-maintained configuration of individual cars in the field.

Data-driven engineering

Use cases

for the digital thread in product operations comprise:

- Requirements optimization by understanding customer behavior in different markets

- Product portfolio and variance optimization by understanding actual function usage in the fleet

- After-sales optimization by tracing back error codes to design data and requirements

- Regulatory compliance, e.g. China Real-Time Monitoring and UNECE R155 / 156 SUMS CSMS for software update and cyber-security management

Product Interoperability

We are leaving the pure vehicle business and entering the smart city and automotive mobility systems. Sustainable mobility requires an intelligent combination of multiple modes of transportation such as public transportation, bikes and car-sharing. This goes along with the trend towards battery-electric vehicles and the underlying charging infrastructure. In consequence, we are looking at a digital thread that connects multiple digital twins, e.g. of the city (HD maps), the driver (preferences and payment) and the vehicle (renting location and traffic information).

Use cases for the digital thread in product interoperability are identified in the following picture:

Interoperability use cases for digital twin / thread

Standards enable the interoperability between domains such as mobility, telco, banking, insurance and utilities. The Digital Twin Consortium (DTC) brings the relevant players together and drives the development and standardization of digital twin technology.

Other relevant standards are STEP and OSLC. The STandard for the Exchange of Product model data (ISO 10303 STEP) provides detailed data models for physical and functional aspects of a product. In our case of automotive, the STEP application protocol AP 242 for managed model-based 3D engineering is of special importance. The Open Services for Lifecycle Collaboration (OSLC) standardize the use of linked data based on web technologies such as REST APIs, URLs and RDF. Please refer to the OSLC Fest 2022 conference including my presentation on “Integration Architecture for the Automotive Digital Thread”.

OSLC Fest 2022 presentation on integration architecture for the automotive digital thread

IT Infrastructure

When looking into the product operations and interoperability use cases, it is obvious that a large part of the digital thread relies on cloud and IoT technology. We also see that the digital thread is in fact a complex enterprise knowledge graph, spanning many applications with different semantics, data models and programming interfaces (APIs).

Our customers are currently designing and building solutions for an integrated digital thread. Some are continuing to build point-to-point integrations, but most are looking for a central link management, either in a PLM backbone or in a dedicated link repository.

To support our customers, we use an integration architecture blueprint which we call SENSEI (Systems Engineering aNd Scalable Enterprise Integration). It organizes multiple integration components such as API management, streaming, messaging, linked data and business process management into a logical integration layer. Please find more information in our SENSEI whitepaper.

SENSEI - NTT DATA systems engineering integration architecture blueprint

Summary

The automotive digital thread spans product development and operations, it even touches other domains such as telco, banking, insurance and utilities in smart city and mobility scenarios. This requires robust, standards-based solutions with good useability. NTT DATA as a systems integrator with comprehensive experience in automotive and other domains offers business consulting and IT implementation services in this field.

Note: this is a cross-post from my LinkedIn article